ISLAMABAD: Federal Minister for Revenue and Finance Miftah Ismail said Monday that the stalled International Monetary Fund’s (IMF) Extended Fund Facility (EFF) would be revived within a day or two.

Speaking to the journalist he said that he is very hopeful that the IMF program would be revived. He said that the government aims at taxing the wealthy and provide relief to the poor through the budget for the fiscal year 2022-23.

Replying to a question he said that IMF has no relation to the increase in salaries. “Also, the tax exemption to the people earning below Rs.1.2 million will remain in place,” he added.

The authorities in the finance ministry were expected to conclude the staff-level agreement by Sunday (June 19) on the basis of revenue and expenditure measures that could deliver next year’s primary budget — the difference between revenues and expenditures, excluding interest payment — in Rs152 billion surplus.

The fund still has reservations over Rs.9.5 trillion expenditures projected by the authorities for the next fiscal year. The revenue measures in the budget, according to IMF estimates, are also insufficient to deliver slightly over the Rs7 trillion target.

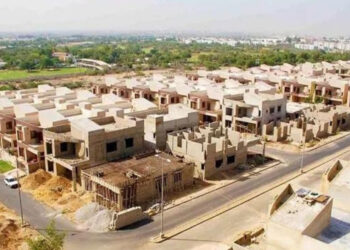

Talking about the proposed taxes on property the finance minister said that once construction begins on an empty plot, it will be exempted from taxes.

“Lay one brick on the empty land and the taxes will be lifted. But we will not impose a tax on anyone who has not acquired the possession of a plot or has not received the permission to start construction on it,” he said.

The finance minister said if a person has been granted permission to start construction on a piece of land and they still do not begin building something on it, then they will have to pay the tax.

In the coalition government’s first budget, the finance minister proposed a 15% capital gains tax on immovable property for a one-year holding period, which will be reduced by 2.5% for every additional year.

Moreover, he has also proposed advance tax on filers to be increased to 2% from the previous 1% on the purchase of property and non-filers 5%.

The authorities in the finance ministry were expected to conclude the staff-level agreement by Sunday (June 19) on the basis of revenue and expenditure measures that could deliver next year’s primary budget — the difference between revenues and expenditures, excluding interest payment — in Rs152 billion surplus.

The fund still has reservations over Rs.9.5 trillion expenditures projected by the authorities for the next fiscal year. The revenue measures in the budget, according to IMF estimates, are also insufficient to deliver slightly over the Rs7 trillion target.