- Home

- Latest News

- Showbiz

Trending Tags

- Thought Box

- Business

- Opinions

- Mobiles

- Technology

- The Other Side

- Home

- Latest News

- Showbiz

Trending Tags

- Thought Box

- Business

- Opinions

- Mobiles

- Technology

- The Other Side

President Zardari enacts tax reforms with new Income Tax Ordinance, 2024

Related Stories

Trending Stories

Opinion

February 5, 2025

- Ambassador Dr. Jamil

February 3, 2025

- Ambassador Dr. Jamil

January 10, 2025

- Munir Ahmed

No posts found

Rain and snowfall hit various parts of the country

Various parts of the country, including Islamabad, are experiencing rain and snow. In Islamabad,...

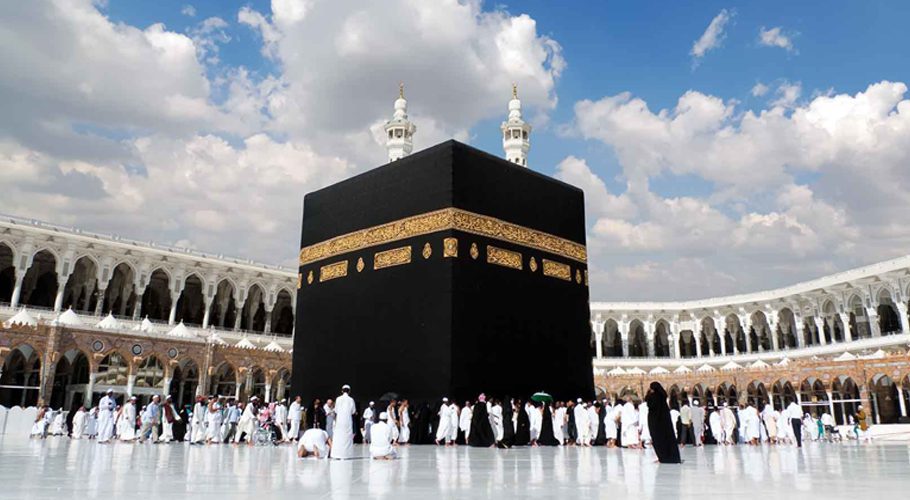

Pakistan announces Hajj refunds of up to Rs140,000 for 2024 pilgrims

If you performed in Hajj in 2024, you may be eligible for a refund...

List of flights canceled from Karachi Airport today

Cancellation of national and international flights from Karachi’s Jinnah International Airport has become an...

MM Digital (Pvt.) Ltd.

MM News is a subsidiary of the MM Group of Companies. It was established in 2019 with the aim of providing people of Pakistan access to unbiased information.

Contact Details: 03200201537