KARACHI: The Pakistan Stock Exchange (PSX) on Wednesday witnessed a robust rally, with the cement and steel sectors spearheading the surge. The benchmark KSE-100 concluded the day at a new pinnacle, reaching 67,756 points, marking a substantial increase of nearly 900 points.

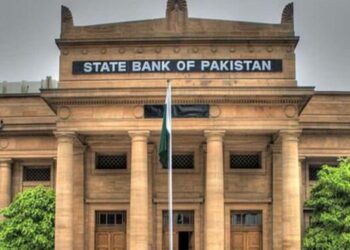

A dip in inflation figures has revived optimism regarding potential monetary easing by the central bank. Additionally, progress on the government’s initiative to privatize State-Owned Enterprises (SOEs) has contributed to the recent streak of record highs for the KSE-100.

Closing at 67,756.03, the benchmark index surged by 869.77 points or 1.30%.

Market activity was particularly pronounced in the cement and steel sectors, with reports indicating increased cement dispatches in March, including a notable uptick in exports.

Mohammed Sohail, CEO of brokerage house Topline Securities, noted during intra-day trading that confidence is on the rise due to advancements in privatization efforts and foreign portfolio investment in government securities. He also highlighted the spotlight on cement stocks amid expectations of forthcoming rate cuts.

In a significant development, the Privatisation Commission issued a call for expressions of interest (EOIs) for the divestment of Pakistan International Airlines Corporation Limited (PIACL) on Tuesday. Interested entities, excluding individuals or government entities, have until May 03, 2024, to submit their EOIs.

Despite the overall positive market sentiment, the share price of PIACL experienced a downturn as investors deliberated their options following a substantial rally in the company’s stock over recent weeks.