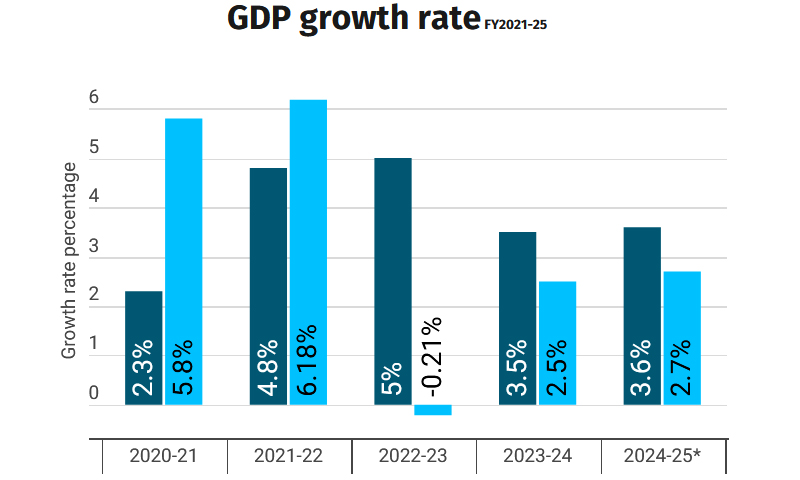

Pakistan has failed meet its targeted GDP growth rate of 3.6% for the outgoing fiscal year, instead recording a provisional growth of 2.7%, according to the Economic Survey 2024–25. The survey was presented on Monday by Finance Minister Muhammad Aurangzeb, formerly the CEO and President of one of the country’s largest commercial banks.

The survey reports that the agriculture, industrial, and services sectors experienced modest performance, registering growth rates of 0.56%, 4.77%, and 2.91%, respectively.

Released ahead of the federal budget, the Economic Survey provides a comprehensive overview of Pakistan’s socio-economic indicators and performance for the fiscal year.

Addressing global economic trends, the finance minister noted that global GDP growth stood at 3.5% in 2023, declined to 3.3% in 2024, and is projected to ease further to 2.8%, based on current estimates.

“Pakistan’s GDP growth was -0.2% in 2023, which improved to 2.5% in FY2024. We now report a growth of 2.7% for FY2025,” said Aurangzeb.

He also said that the size of Pakistan’s economy increased from $372 billion in FY2024 to $411 billion in the outgoing fiscal year.

Aurangzeb acknowledged the underwhelming performance of the agriculture sector, stating that had it maintained previous growth levels, the overall GDP would have been closer to the initial target. Growth in key crops, including cotton, maize, and wheat, declined by 13.5%.

Describing the current economic trajectory as a gradual recovery, Aurangzeb said, “From my perspective, this is the appropriate path toward sustainable growth.”

He stressed the government’s commitment to avoiding a recurrence of the traditional boom-and-bust cycle, adding, “We intend to maintain course to ensure a stable and sustainable growth trajectory.”

On the inflation front, Aurangzeb noted a substantial decline in the consumer price index, which had surged beyond 29% in 2023 but has since fallen to 4.6%. “I believe we are moving in the right direction,” he said.

Moreover, the finance minister said a reduction in the country’s debt-to-GDP ratio, which decreased from 68% to 65%.