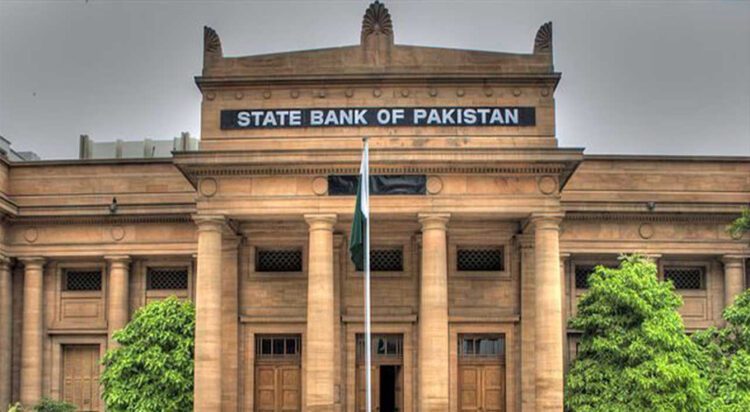

The Monetary Policy Committee (MPC) of the State Bank of Pakistan (SBP) has further reduced the key policy rate by 200 basis points, bringing it down to 13%.

“In its meeting today, the Monetary Policy Committee (MPC) decided to lower the policy rate by 200 basis points to 13%, effective from December 17, 2024,” the MPC announced in its statement.

This follows the previous rate cut on November 4, 2024, when the MPC reduced the policy rate by 250 basis points, lowering it to 15%.

The rate cut was primarily driven by a sustained decline in food inflation and the fading impact of the gas tariff hike implemented in November 2023. However, the Committee observed that core inflation, currently at 9.7%, remains persistently high, while inflation expectations among consumers and businesses continue to fluctuate.

The Committee highlighted several key developments since its last meeting that could influence the macroeconomic outlook:

- Current Account Surplus: The current account remained in surplus for the third consecutive month in October 2024. This surplus, despite weak financial inflows and significant official debt repayments, contributed to an increase in the SBP’s foreign exchange reserves, which now stand at approximately $12 billion.

- Global Commodity Prices: International commodity prices remained favorable, positively impacting domestic inflation and reducing the import bill.

- Private Sector Credit Growth: Credit to the private sector saw a notable increase, reflecting the easing of financial conditions and banks’ efforts to comply with advances-to-deposit ratio (ADR) thresholds.