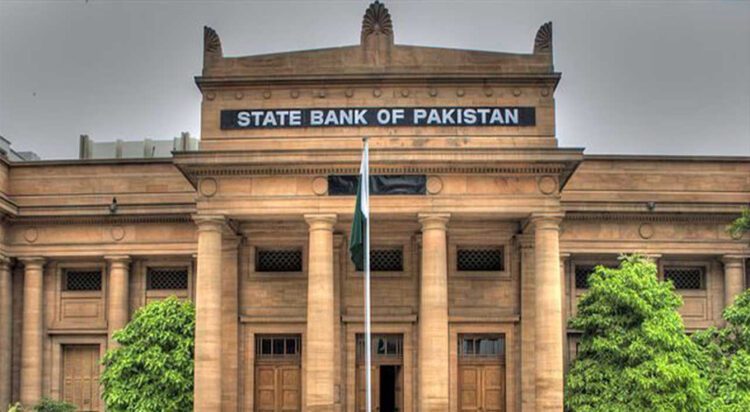

The Monetary Policy Committee (MPC) of the State Bank of Pakistan (SBP) has cut the policy rate by 100 basis points (bps) to 11%. This marks the lowest rate since March 2022, when it stood at 9.75 percent.

According to a statement issued on Monday, the MPC highlighted a notable decline in inflation during March and April, primarily due to reduced electricity tariffs and a continued decrease in food prices. Core inflation also eased in April, aided by favorable base effects and subdued demand.

The rate cut—larger than most market forecasts—was described by Topline Securities CEO Mohammed Sohail as exceeding expectations. Since June, the central bank has reduced the benchmark rate by a cumulative 1,100 basis points, down from its record high of 22 percent.

“The inflation outlook has improved further compared to the previous assessment,” the MPC stated. However, it cautioned that ongoing global uncertainties, including trade tensions and geopolitical risks, could still pose challenges to economic stability. In light of these factors, the Committee underscored the need for a cautious and balanced approach to monetary policy.

The SBP also reported that headline inflation dropped to 0.3 percent year-on-year in April. This decline was largely attributed to falling wheat prices, easing global commodity costs, and recent reductions in electricity tariffs. These developments, the central bank noted, have contributed to a softening of inflation expectations among consumers.