Swiss banks have the world’s most closely guarded secrecy laws and protect the identities of some of the world’s richest people into how they accumulated their fortunes.

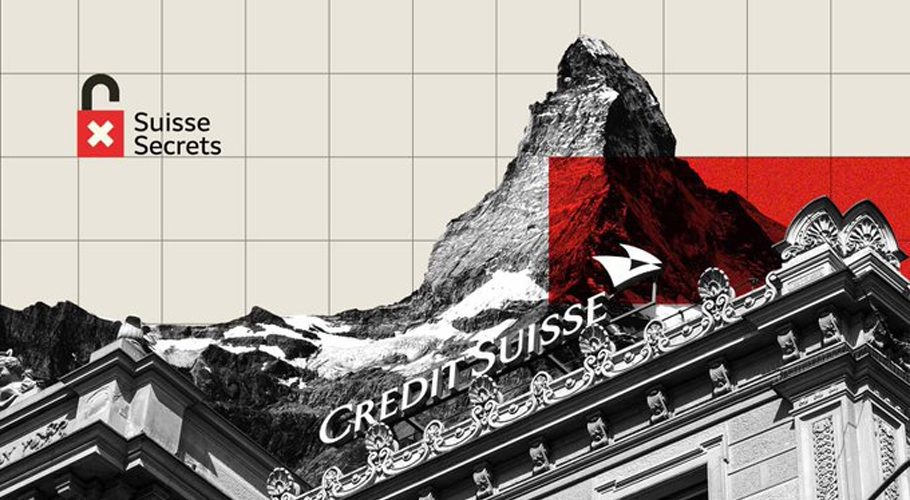

Now an extraordinary leak of data from Credit Suisse, Switzerland’s second-largest lender, has exposed how the bank held hundreds of millions of dollars for heads of state, intelligence officials, sanctioned businessmen, and human rights abusers.

A self-described whistle-blower leaked data on more than 18,000 bank accounts, collectively holding more than $100 billion to a German newspaper last year. It is the only known leak of a major Swiss bank’s client data to journalists.

The newspaper shared the data with a nonprofit journalism group, the Organized Crime and Corruption Reporting Project, and 46 other news organisations around the world.

What is Suisse Secrets?

Suisse Secrets is an international investigation into one of the world’s wealthiest and most important banks. More than 163 journalists from 48 media outlets in 39 countries across the world spent months analysing bank account information leaked from Credit Suisse.

Switzerland is a known destination for money from all over the world due to its banking secrecy laws. It is not illegal to have a Swiss bank account but banks are supposed to avoid clients who earned money illegally or were involved in crimes.

The investigation identified dozens of corrupt government officials, criminals, and alleged human rights abusers among Credit Suisse account holders. The bank maintained relationships with some of these clients for years, though it is possible that some accounts were ordered frozen by law enforcement.

The Suisse Secrets project investigates these account holders who exploit Swiss banking secrecy and how the international financial industry enables theft and corruption. Credit Suisse has pledged to reform its due practices over the years. The project highlights the need for increased accountability in this sector.

Where did the data come from?

The Suisse Secrets data was provided to the German newspaper Süddeutsche Zeitung by an anonymous source more than a year ago. Nothing is known about the source’s identity. The source did provide a statement explaining his or her motivations.

“I believe that Swiss banking secrecy laws are immoral. The pretext of protecting financial privacy is merely a fig leaf covering the shameful role of Swiss banks as collaborators of tax evaders. … This situation enables corruption and starves developing countries of much-needed tax revenue.”

“I want to emphasize the fact that the responsibility for this state of affairs does not lie with Swiss banks but rather with the Swiss legal system. Banks are simply being good capitalists by maximizing profits within the legal framework they operate in. Simply put, Swiss legislators are responsible for enabling financial crimes and — by virtue of their direct democracy — the Swiss people have the power to do something about it.”

“I am aware that having an offshore Swiss bank account does not necessarily imply tax evasion or any other financial crime. I am sure that some of the accounts … have a legitimate reason for existing or that they have been declared to tax authorities in compliance with the relevant legislation. However, it is likely that a significant number of these accounts were opened with the sole purpose of hiding their holder’s wealth.”

What’s in the leaked data?

The leaked data includes information about more than 18,000 Credit Suisse accounts and 30,000 account holders. Some clients hold multiple accounts controlled by several clients. There is no indication of whether they are checking, savings, or investment accounts.

Some account holders are people, while others are legal entities such as companies domiciled in more than 120 jurisdictions and 160 nationalities. The total amount of money held in the accounts at their maximum was more than US$100 billion.

The average account held about 7.5 million Swiss francs at its largest point. Over a dozen accounts held more than 1 billion Swiss francs. These figures do not give any indication of the total amount of money moved through the accounts over the years.

The data does not extend through the present day although many of the accounts remained open well into the 2010s. Most account openings were opened in 2007 and 2008. The account closings peaked in 2014 with the introduction of new regulations in Switzerland to automatically exchange tax information on clients with foreign residency. The average account was open for about 11 years.

Who has been named so far?

Among the people listed as holding amounts worth millions of dollars in Credit Suisse accounts were King Abdullah II of Jordan and the two sons of the former Egyptian dictator Hosni Mubarak. Those cases that merited publication involved clients known to have been high-risk, politically connected, accused or convicted of serious crimes.

One example is Rodoljub Radulovic, a high-ranking member of one of Eastern Europe’s largest cocaine-smuggling cartels, led by the notorious Serbian drug lord Darko Saric. Radulovic was able to open a Credit Suisse account despite a long history of involvement in financial scandals in the United States. He then used it to launder over 3 million euros worth of drug money

Another is Eduard Seidel, a former top executive in Nigeria for German telecommunications giant Siemens, whose accounts contained tens of millions of Swiss francs. Two of them remained open for almost a decade after allegations of his involvement in a major bribery scandal in Nigeria first broke.

Also included is Muller Conrad ‘Billy’ Rautenbach, a mining magnate who has boasted of bribing and was sanctioned by the US and EU. He opened high-value accounts at Credit Suisse even after the UN warned he was allegedly overseeing corrupt mining deals in the Democratic Republic of Congo.

Are Pakistanis included?

According to details, the data reveals that 1,400 Pakistani citizens are linked to approximately 600 Credit Suisse accounts. It also included information about accounts that were closed but were still operational in the past.

A report by a Pakistan-based media channel that collaborated with the investigation revealed the data contained details about several cases currently under investigation in Pakistan in which investigators were given incorrect information about the assets under scrutiny.

It has emerged that Pakistanis have also used Credit Suisse to open accounts in their proxies’ names in the absence of the bank conducting proper due diligence.

The leak follows the so-called Panama Papers in 2016, Paradise Papers in 2017 and Pandora Papers last year. The new disclosures are likely to intensify legal and political scrutiny of the Swiss banking industry and Credit Suisse.