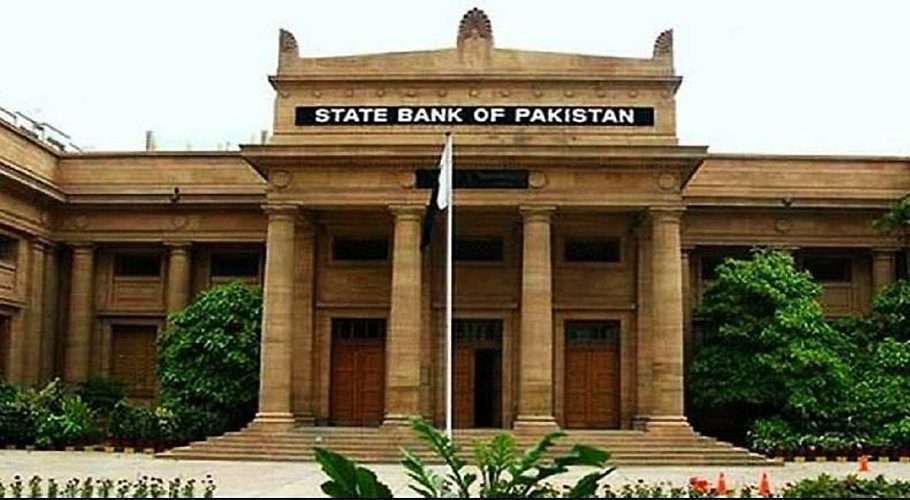

KARACHI: While Pakistan attempts to fix its financial situation and obtain a $1 billion loan from the International Monetary Fund, the State Bank of Pakistan (SBP) is anticipated to increase interest rates in an off-cycle review this week (IMF).

Investors anticipate a minimum 200 basis point hike in the central bank’s policy rate, which is now at 17%, according to market participants in a recent treasury bill auction, Reuters reported.

The upcoming interest rate increase is an indication that Pakistan’s central bank is committed to taking the necessary steps to improve the country’s budgetary condition. By making borrowing money from the government more expensive, rising interest rates will also assist to reduce inflation.

In yesterday’s T-bills auction, the SBP on Thursday received bids worth Rs246.74bn for 3 months, Rs50bn for 6 months, and Rs50bn for 12 months, out of which it accepted Rs151.74bn, Rs12bn, and Rs10bn, respectively. In addition, the SBP picked up Rs84.01bn from the non-competitive auction, making the total amount accepted Rs257.74bn.

This move by the SBP indicates that the central bank is adopting a hawkish stance to curb inflation, which has been steadily rising in recent months.

With the hike in policy rate expected in the near future, borrowers may face higher borrowing costs, which could negatively impact economic growth.

On the other hand, savers could benefit from higher returns on their investments.