![]() Follow Us on Google News

Follow Us on Google News

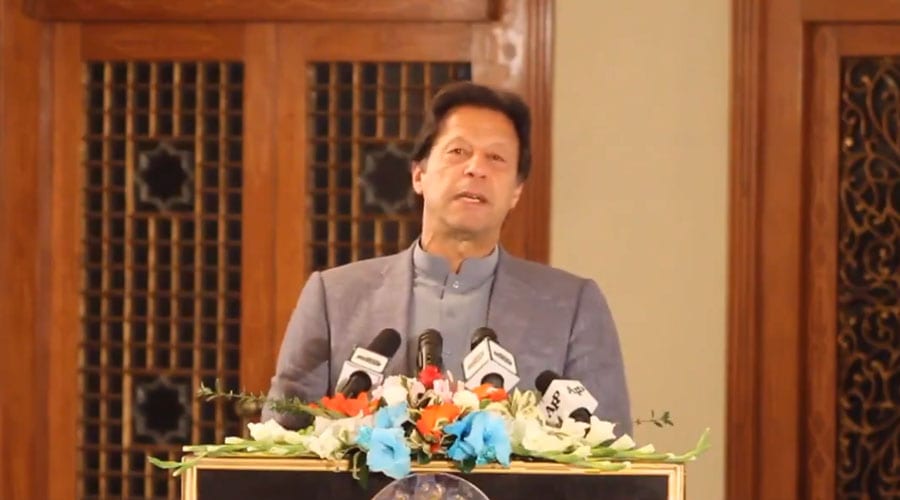

PM launches Ehsaas Financial Inclusion Initiatives

Related Stories

Opinion

April 17, 2024

- Dr. Muhammad Shahbaz

March 19, 2024

- Riyatullah Farooqui

March 17, 2024

- Ambassador Dr. Jamil

No posts found

Is Dubai’s storm coming to Pakistan?

The United Arab Emirates (UAE) witnessed extensive flooding on Tuesday when storms unleashed more...

Chicken price reaches Rs495 per kg amid poultry traders’ strike

Poultry prices in Punjab have skyrocketed as the Punjab Poultry Traders Association initiated a...

New Pink Bus routes announced for Karachi

KARACHI: Sindh Minister for Transport and Mass Transit, Sharjeel Inam Memon, has announced the...

MM Digital (Pvt.) Ltd.

MM News is a subsidiary of the MM Group of Companies. It was established in 2019 with the aim of providing people of Pakistan access to unbiased information.

Contact Details: 03200201537