KARACHI: Pakistan Stock Exchange’s benchmark KSE-100 index on Monday plunged nearly 700 points right after the opening bell, with the sharp slump being attributed to the central bank’s surprise move to hike the policy rate by 100 basis points on Friday evening.

Also read: SBP raises interest rate to 16 percent, the highest since 1999

It may be recalled that the State Bank on Friday had raised its key policy rate by 100 basis points to a 24-year high of 16pc on Friday in a decision that went against market expectations but, according to the central bank, was “aimed at ensuring that elevated inflation does not become entrenched”. The move brings the SBP interest rates hikes to 625 basis points this year.

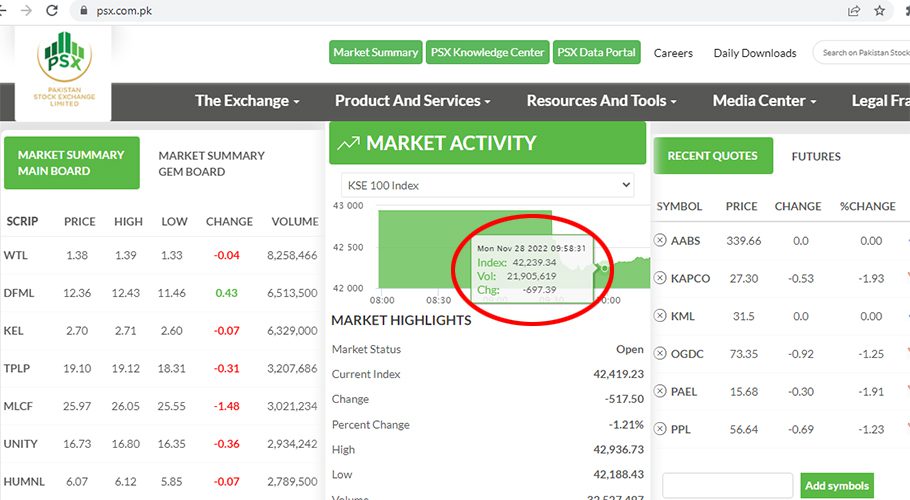

The index on Monday was down 697 points to reach 42,239.34 points at 9:58am today. Raza Jafri, head of Research at Intermarket Securities was quoted as having said that the market had opened sharply negative as it factored in higher interest rates and continued uncertainty on the political front after Imran Khan’s threat to dissolve the Punjab and Khyber Pakhtunkhwa assemblies.

He further said that “support may come in later on, as positives such as Pakistan’s intent to repay its maturing Sukuk ahead of schedule and the end to the long march, which risked street confrontation,” he added.