Inflation is a measure of rising prices of goods and services in an economy. Inflation can occur as prices rise due to increases in production costs, such as raw materials and wages. A surge in demand for products and services can cause inflation as consumers are willing to pay more for the product. Some companies reap the rewards of inflation if they can charge more for their products as a result of high demand for their goods. Inflation can occur in nearly any product or service, including need-based expenses such as housing, food, medical care, and utilities, as well as want expenses, such as cosmetics, automobiles, and jewelry. Once inflation becomes prevalent throughout an economy, the expectation of further inflation becomes an overriding concern in the consciousness of consumers and businesses alike. Inflation can be a concern because it makes money saved today less valuable tomorrow.

Importantly, inflation is a tax that erodes the purchasing power of the currency. Thus, the poor, who hold much of their assets in cash, bear this tax disproportionately, while the rich can partly evade it by holding assets that are return-bearing (like bonds), increasing in value (like land), or in a stable foreign currency (like the dollar). Inflation erodes a consumer’s purchasing power and can even interfere with the ability to retire. For example, if an investor earned 5% from investments in stocks and bonds, but inflation rate was 3%, the investor only earned 2% in real terms. It may be one of the most familiar words in economics. Inflation has plunged countries into long periods of instability. Central bankers often aspire to be known as “inflation hawks.”

Politicians have won elections with promises to combat inflation, only to lose power after failing to do so. Inflation was even declared public enemy no. 1 in the United States by President Gerald Ford in 1974.

The US dollar hit an all-time high against an already debilitated Pakistani rupee. The greenback that began its streak against the Pakistani rupee last month following an ongoing political crisis, which also saw the ouster of former premier Imran Khan’s government through a successful no trust motion traded at Rs 200.5 in the open market. Apart from the ongoing political instability, economists cite the country’s depleting foreign reserves, rising imports, and the government’s “reluctance” to take decisions on some International Monetary Fund (IMF) conditions, as key factors behind greenback’s upward march.

The IMF that announced a $6 billion bailout package to prop up the South Asian nation’s sputtering economy in 2019, demands withdrawal of subsidies on several items, mainly petroleum and electricity. This has forced the newly-elected Prime Minister Shehbaz Sharif to retain petroleum prices in order to avoid a public backlash, despite rising prices on the international markets. Annual inflation rate in Pakistan increased to 24.9% in July of 2022, the highest since October of 2008, from 21.3% in June, amid a slide in the rupee to fresh record lows.

Transport prices recorded the biggest increase (64.7%), namely motor fuels (94.4%); followed by food and non-alcoholic beverages (28.8%), mainly vegetables (40.5%), pulses (92.4%), cooking oil (72.6%), wheat (45%) and milk (24.8%); restaurants and hotels (25%), alcoholic beverages and tobacco (22.5%), and housing and utilities (21.8%), namely electricity charges (86.7%). Compared to the previous month, consumer prices were up 4.4%. In Pakistan, most important categories in the consumer price index are food and non-alcoholic beverages (35% of total weight); housing, water, electricity, gas and fuels (29%); clothing and footwear (8%) and transport (7%). The index also includes furnishings and household equipment (4%), education (4%), communication (3%) and health (2%).

The remaining 8% is composed by: recreation and culture, restaurants and hotels, alcoholic beverages and tobacco and other goods and services. The federal government set the inflation target at 11.5% for this fiscal year but the SBP distanced itself from the official target, saying that the inflation may remain in the range of 18% to 20% during the current fiscal year. The prices of all essential products seemed to slip out of the control of authorities, particularly crucial kitchen items like edible oil. The prices of onions jumped 100% last month compared to a year ago, followed by a 90% increase in the rates of pulses in the rural areas and 83% for various types of ghee and cooking oil.

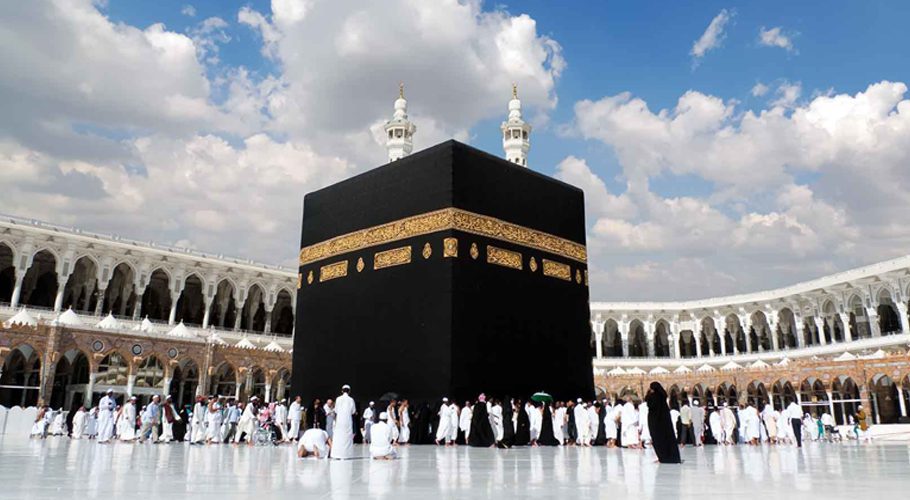

Multiple reasons can account for the surprise appreciation in the Pakistani rupee against US Dollar. Few reasons discussed in different forums and webinars are; postponing of loans, getting relief aid, exports having achieved higher growth than imports, increase in remittances, current account surplus, saving in forex spending on foreign tours, foreign education, Umrah and Hajj, dollars inflow in open market and possibility of increase in for-ex reserves. But inflation is still high due to some reasons which are as; the first is money growth. For a fixed supply of goods, more money in circulation means higher prices. Monetary loosening can happen due to structural factors like fiscal dominance, where the central bank is forced to print money to finance fiscal deficits; and/ or cyclical surges in capital inflows, and the accompanying credit/ real estate booms. The second is factors that affect import prices.

As a heavily oil-reliant importer, and with no real foreign exchange or fiscal buffers to limit pass-through to domestic prices, a part of Pakistani inflation is simply determined by global oil price movements. The third is domestic supply shocks. Floods, droughts, crop pests can all raise the price of domestic goods, and often goods that are essential to the poor.

While governments cannot wish these shocks away, it can and must invest in resilience mechanisms, as these are likely to benefit the poor most. In sum, inflation is a multi-source problem. It has been high, but manageable, in Pakistan. Inflation affects the poor disproportionately, the government must continue to take structural measures to keep it low, and to compensate the poor via lifeline tariffs and cash transfers for any temporary surges. It seems that inflation is a governance issue not really linked with Dollar.