The 2022 Pakistan economic crisis is an ongoing economic crisis that has caused severe economic challenges for months due to which food, gas and oil prices have risen.

Russia’s war in Ukraine has caused even more energy problems in the country as inflation is at all-time high. Pakistan’s economic crisis was at the center of a political standoff between Prime Minister Shahbaz Sharif and his predecessor Imran Khan earlier this year, which led to Khan’s ouster in April 2022. Sharif accused Khan of economic mismanagement and mishandling of the country’s foreign policy, forcing him to step down in a no-confidence vote. Pakistan’s economy is expected to grow by only 2% in the current fiscal year ending June 2023. Inflation and the Poor, the slower growth will reflect damages and disruptions caused by catastrophic floods, a tight monetary stance, high inflation, and a less conducive global environment. Recovery will be gradual, with real GDP growth projected to reach 3.2% in fiscal year 2024. Pakistan was committed to “controlling rising inflation, stabilizing foreign exchange reserves, strengthening the economy and reducing the country’s dependence on imports”. Import of unnecessary and luxury items was banned. Sharif had said at the time that the decision would “save the country’s precious foreign exchange” and that Pakistan would have to “pursue austerity”. Concerns are rising again over the health of Pakistan’s economy as foreign reserves run low, the local currency weakens and inflation stands at decades-high levels despite the resumption of an International Monetary Fund funding programme. The biggest worries center on Pakistan’s ability to pay for imports such as energy and food and to meet sovereign debt obligations abroad. Before the floods hit, external financing needs for the 2022-23 financial year (July-June) were estimated at $33.5 billion, according the central bank. In late May 2022, the government lifted the cap on fuel prices a condition for advancing the long-stalled bailout deal with the International Monetary Fund (IMF). IMF also insisted Islamabad to raise electricity prices, ramp up tax collection and make sizeable budget cuts. Pakistanis could reduce their tea consumption to “one or two cups” a day as imports were putting additional financial pressure on the government. According to the Observatory of Economic Complexity, the South Asian nation of 220 million is the world’s largest tea importer, having bought more than $ 640 million worth of tea in 2020.

The IMF programme was meant to stabilize an economy that has been in a tailspin for months. The nuclear-armed country has suffered from external shocks like other developing nations heavily reliant on imports of oil, gas and other commodities. On 10 June 2022, the government unveiled a new 47 billion budget for 2022-23 to persuade the IMF to resume the 6 billion bailout deal, which was agreed upon by both sides in 2019. The IMF programme assuaged immediate default fears, but concerns have resurfaced. With initial estimates putting flood losses at $30 billion and financing needs rising. Global bond markets reacted sharply. The government clarified it was only seeking relief from bilateral creditors, and would meet private debt obligations. The economic situation is not the only concern. Pakistan is in the grip of political instability. The floods have changed projections. Exports are expected to slump and imports to grow to make up for essential commodities lost in the flooding of millions of hectares of farmland, killed more than 1,500 people and caused billions of dollars’ worth of damage, heaping even more pressure on its finances. Poverty in the hardest-hit regions will likely worsen in the context of the recent flooding. Preliminary estimates suggest that without decisive relief and recovery efforts to help the poor the national poverty rate may increase by 2.5 to 4 percentage points, pushing between 5.8 and 9 million people into poverty. Macroeconomic risks also remain high as Pakistan faces challenges associated with a large current account deficit, high public debt, and lower demand from its traditional export markets amid subdued global growth. “The recent floods are expected to have a substantial negative impact on Pakistan’s economy and on the poor, mostly through the disruption of agricultural production. “The Government must strike a balance in meeting extensive relief and recovery needs, while staying on track with overdue macroeconomic reforms. It will be more important than ever to carefully target relief to the poor, constrain the fiscal deficit within sustainable limits, maintain a tight monetary policy stance, ensure continued exchange rate flexibility, and make progress on critical structural reforms, especially those in the energy sector”.

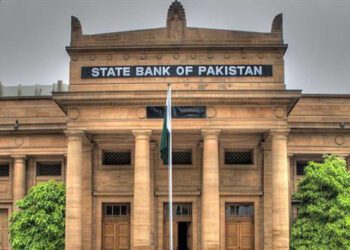

Inflation in Pakistan rose to 21.3% in June, the highest since December 2008 when inflation stood at 23.3%. Inflation in Pakistan is expected to reach around 23% in FY23, reflecting flood-related disruptions to the supply of food and other goods, higher energy prices, and difficult external conditions, including tighter global monetary conditions. The Update shows that the high inflation will disproportionately impact the poor. High inflation, unemployment and low profitability continue to plague the business community and despite that the government has withdrawn its electricity concession given to exporters and is projected to increase the levy on petrol and diesel to Rs50 per liter by January 2023. Adding to their miseries, the government is also considering imposing GST all negative indicators for the country’s economy. The consistent depreciation of the rupee is deepening economic crisis in the country said the Pakistan Business Forum (PBF), as its leaders called upon the State Bank of Pakistan (SBP) to take necessary measures to stop market speculation and resolve the issue.

Foreign exchange reserves with the central bank stand at $8 billion and commercial banks hold another $5.7 billion. That covers imports for barely a month, despite IMF funding. At the end of March 2022, the State Bank of Pakistan’s reserves stood at $11.425bn, but they gradually tanked to an almost four-year low of $6.715bn on 2nd December. Pakistan’s forex reserves equal to just five weeks of merchandise imports.

“Even bond and currency markets, which had shown more confidence in Pakistan after the IMF deal, are pricing in high once again over concerns of the country defaulting on its foreign debt”. “Since the end of August, the yields on some of the government’s international bonds have jumped by a third, while the currency is one of the worst performing in Asia”. “Is it not shameful for Pakistan that we rejoice in repaying the $1 billion Sukuk, but don’t take any steps to save the dollars we are wasting? Using daylight will save $3.5 billion”. “We still have foreign debt of $130 billion and $73 billion due in three years. Our deficit for next three years is a minimum of $20 to $30 billion. Additionally, super inflation is killing the poor. This is a financial emergency”. The foreign commercial loans were targeted at $7.7 billion for FY 2023, while the government was only able to receive $0.2 billion during July-October 2022, he said, adding that “The Chinese deposit rollover of $4 billion is still pending”. The consistent depreciation of the rupee is deepening the economic crisis in Pakistan, and the country “in financial emergency”. At the end of March, the rupee stood at 183.48 to $1. On 29 December 2022, it closed at 226.69. Pakistan’s rupee has weakened 20% since the start of the year and hit its weakest level on record in August, reflecting both the country’s fragile financial situation as well as the strong dollar itself. The crisis has been fuelled by political turmoil and external shocks from the global commodity crunch.

Typically, a third of Pakistan’s import payments relate to energy. In the last financial year, petroleum group imports, including LNG, more than doubled to $23.3 billion from a year earlier, according to the statistics bureau. Most of its electricity is produced using LNG, prices of which remain elevated and which will be in shorter supply with the winter approaching. Higher energy bills propelled Pakistan’s current account deficit to over $17 billion – close to 5% of GDP – in the last financial year, six times higher than 2020-21, despite record high remittances from abroad. An overheating economy also contributed to the widening deficit. Imports rose 42% to a record $80 billion in the last financial year; exports also hit a record of nearly $32 billion but grew 25%. The decline in the currency is pushing up the cost of imports, borrowing and debt servicing, and in turn will further exacerbate inflation running already at a multi-decade high of 27.3%. Immediate solutions include financing and compressing demand for imports, but needs are rising after the floods. However, with investors demanding a 26 percentage point premium to hold Pakistan’s international bonds over safe-haven U.S. Treasuries, Pakistan is locked out of international capital markets. There have been some indications the next IMF disbursement could be quicker and front-loaded to help Pakistan combat the floods, but the programme runs out mid-2023. The government says it expects increased financing from other multilateral lenders. Saudi Arabia, United Arab Emirates and Qatar had pledged some $5 billion in investments. That would boost both finances and confidence. Pakistan is talking to bilateral debt holders, including the Paris Club, to restructure payments. But China is the key, holding nearly $30 billion of Pakistan’s debt, including loans by its state-owned banks.