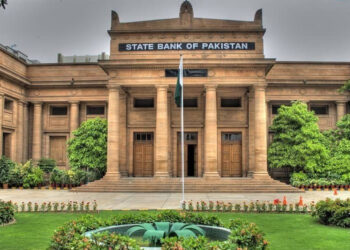

KARACHI: The State Bank today (Wednesday) said Pakistan recorded a 30 percent growth in Islamic banking assets during the 2020 fiscal year.

“The overall assets and deposits of the Islamic banking industry (IBI) have shown tremendous growth of 30 percent and 27.8 percent, respectively, during CY2020,” said the press statement by the central bank.

The report further said this was the highest increase in assets in a year since 2012 and in deposits since 2015. Over the last five years, both assets and deposits of the Islamic banking industry have more than doubled.

“This growth in assets and deposits of the Islamic banking industry is encouraging, particularly due to the fact that the industry was also faced with the COVID-19 pandemic challenges during 2020,” the report added.

According to its bulletin, the assets of the IBI increased to Rs4,269 billion, whereas deposits reached Rs3,389 billion by the end of December 2020 which mark a 17.0 pc composition in total assets while respectively, an 18.3 pc in total deposits recorded by the overall banking industry in this period.

Financing of the Islamic banking industry has also grown by 16 percent during CY20. “In continuation of its ongoing strategy, State Bank remains committed towards promotion of Islamic banking industry on sound and sustainable basis in the country by providing a level playing field”, the report concluded.