In 2024, gold prices in Pakistan exhibited significant volatility, peaking at a record high of Rs287,900 per tola and dropping to a low of Rs210,800 per tola. As of today, the price stands at Rs276,900 per tola. This raises the question: will the price of gold continue to rise?

The trajectory of gold prices will likely hinge on several factors, including policy decisions under a potential second Donald Trump presidency. Investors are closely monitoring U.S. interest rate policies and potential tariff adjustments, which are expected to influence gold’s performance heading into 2025.

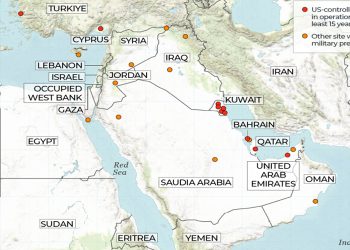

Looking ahead, the year 2025 promises to be intriguing. Geopolitical tensions remain high, with the Middle East still in turmoil and the Russia-Ukraine conflict showing no signs of resolution.

Recent reports suggest that a proposal by the incoming Trump administration to delay Ukraine’s NATO membership by a decade has been rejected by the Kremlin. For Russia, Ukraine’s potential NATO membership remains a central issue driving the conflict. These developments are likely to sustain geopolitical risk premiums, supporting safe-haven demand for gold.

Global central banks played a pivotal role in driving gold prices higher in 2024, and this trend is expected to persist. A World Gold Council survey conducted in the latter half of 2024 revealed that central banks plan to increase their gold purchases over the next 12 months, which could further boost demand for the precious metal.

However, predicting gold prices remains challenging due to uncertainties around U.S. economic policies.