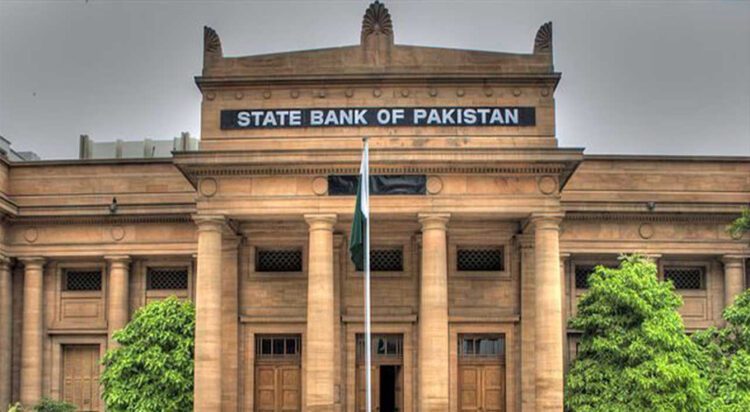

The State Bank of Pakistan (SBP) has instructed banks to open new accounts within two working days, aiming to boost financial inclusion and improve user experience.

The SBP announced that account opening processes for individuals and businesses have been simplified. Regulated entities (REs) must now provide digital payment acceptance solutions to both in-store and online merchants.

The SBP emphasized that banks should ensure customers can track the status of their applications, promoting transparency. A consolidated framework has been introduced to standardize procedures, streamline documentation, and enable secure digital interfaces across all customer touchpoints.

These reforms are part of SBP’s broader strategy to expand access to financial services. As per PwC’s 2024 Banking Publication, Pakistan’s financial inclusion rate reached 60 percent in 2023, with the share of the global unbanked adult population falling from 9 percent in 2021 to 4 percent.

The new framework permits digital onboarding for all account types. Moreover, SBP has mandated that all merchants—new and existing—must offer at least one digital payment method, such as Raast QR codes, POS terminals, or e-commerce checkouts. REs have been directed to support small businesses by classifying merchants into micro, small, and registered categories.