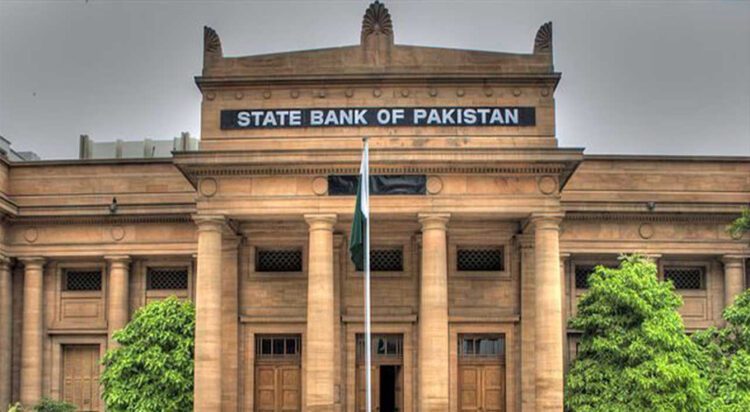

The State of Pakistan has maintained the key policy rate unchanged at 11% during its June 16, 2025 meeting.

The Committee noted that the increase in inflation in May to 3.5 percent y/y was in line with its expectation, whereas core inflation declined marginally.

Meanwhile, inflation expectations of both households and businesses moderated. Going forward, inflation is expected to trend up and stabilize in the target range during FY26. The MPC also assessed that economic growth is picking up gradually and is projected to gain further traction next year, supported by the still-unfolding impact of earlier policy rate cuts.

At the same time, the Committee noted some potential risks to the external sector amidst the sustained widening in the trade deficit and weak financial inflows. Moreover, some of the proposed FY26 budgetary measures may further widen the trade deficit by increasing imports. In this regard, the Committee deemed today’s decision appropriate to sustain the macroeconomic and price stability.

Committee noted the following key developments since its last meeting. First, the real GDP growth for FY25 is provisionally reported at 2.7 percent, and the government is targeting higher growth of 4.2 percent for next year. Second, despite a substantial widening in the trade deficit, the current account remained broadly balanced in April.

Meanwhile, the completion of the first EFF review led to the disbursement of around $1 billion, which increased the SBP’s FX reserves to $11.7 billion as of June 6.