![]() Follow Us on Google News

Follow Us on Google News

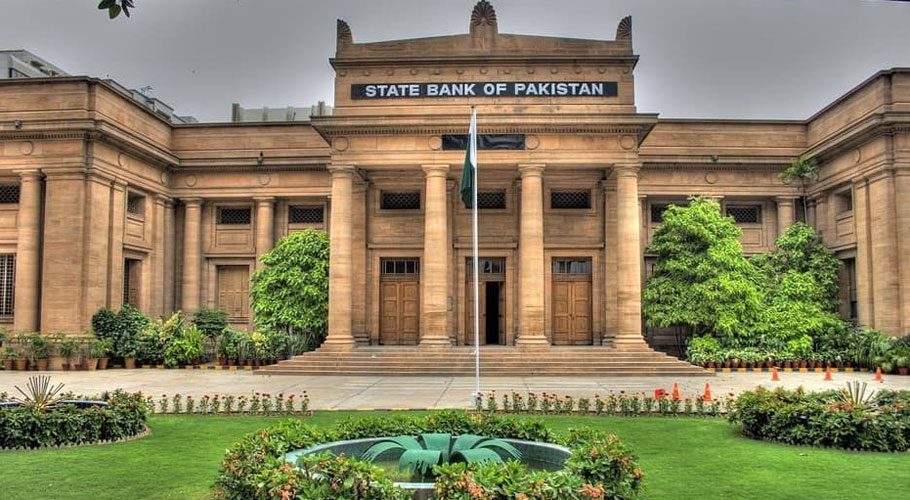

KARACHI: The State Bank of Pakistan (SBP) on Thursday raised its benchmark interest rate by 250 basis points to 12.25 per cent as it grapples with political turmoil and uncertainty over the stalled International Monetary Fund (IMF) loan facility.

“In an emergency meeting today, MPC (Monetary Policy Committee) decided to raise policy rate by 250bps to 12.25%. This strong and proactive policy response was necessitated by a deterioration in outlook for inflation and increase in risks to external stability since last meeting,” the SBP said in a statement.

1/3 In an emergency meeting today, MPC decided to raise policy rate by 250bps to 12.25%. This strong and proactive policy response was necessitated by a deterioration in outlook for inflation and increase in risks to external stability since last meeting. https://t.co/VSRwxRQJhY

— SBP (@StateBank_Pak) April 7, 2022

It added, “The MPC noted that SBP is also taking further complementary actions to reduce pressures on inflation and the current account, namely an increase in the interest rate on the export refinance scheme (EFS) and widening the set of import items subject to cash margin requirements.”

3/3 Looking ahead, the MPC noted that today’s decisive actions, together with a reduction in domestic political uncertainty and prudent fiscal policies, should help ensure that Pakistan’s robust economic recovery from Covid remains sustainable.

See: https://t.co/vyfs83ngsS— SBP (@StateBank_Pak) April 7, 2022

“Looking ahead, the MPC noted that today’s decisive actions, together with a reduction in domestic political uncertainty and prudent fiscal policies, should help ensure that Pakistan’s robust economic recovery from Covid remains sustainable,” it concluded.

More to follow