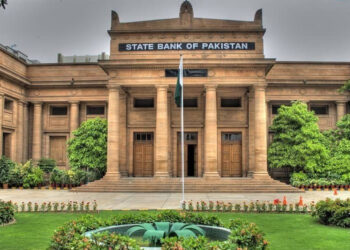

KARACHI: The State Bank of Pakistan (SBP) has introduced a framework to grant licences for setting up digital banks that will provide all the banking services, from account opening to deposit and lending, through digital means and the customers will not need to visit any branch physically.

“The SBP has set the stage for the dawn of a new era for banking in Pakistan with the introduction of a Licensing and Regulatory Framework for digital banks in line with international best practices,” said the central bank in a statement.

The framework for digital banks is the latest in a series of recent initiatives by the SBP towards the digitalisation of banking and payment solutions in the country. Other recent digitalisation initiatives introduced by the SBP include customers’ digital on-boarding, Roshan Digital Account, Raast — instant payment system, electronic money institutions licences, and Asaan Mobile Accounts.

The newly-issued licensing and regulatory framework provides details for setting up digital banks as a separate and distinct category in Pakistan. Digital bank is defined as a bank that offers all kinds of financial products and services primarily through digital platforms or electronic channels instead of physical branches.

Under this framework, SBP may grant two types of digital bank licenses: Digital Retail Bank (DRB) and Digital Full Bank (DFB). DRBs will primarily focus on retail customers while DFBs can deal with retail customers as well as business and corporate entities.

The framework mainly aims to enhance financial inclusion through affordable and cost-effective digital financial services and is part of SBP’s efforts to promote digital financial services in Pakistan.

The framework includes guidance regarding licensing requirements, potential sponsors and permissible use-cases during different phases. It also sets an expectation from applicants to have sound digital governance, robust, secure and resilient technology infrastructure, effective data management strategy and practices.

As per the framework, digital banks are required to maintain a principal place of business in Pakistan to house the offices of their management, staff, other support operations and serve as the main hub/point of contact for various stakeholders including SBP and other regulators.

Setting up digital banks will also require less capital relative to the brick-and-mortar banks currently in existence, encouraging new technology oriented entrepreneurs to enter this new realm of business.

The minimum capital requirement for DRBs is set at Rs1.5 billion during the pilot phase that will gradually increase to Rs. 4 billion over a transition period of three years.

In line with international best practices and assessment of the overall banking situation in Pakistan, the SBP has decided to initially issue up to five digital banks’ licences. The newly issued licensing and regulatory framework provide complete procedure for setting up digital banks as a separate and distinct category in Pakistan.

The licences for DRBs and DFBs may be obtained for both conventional and Islamic variants. Further, conventional variants of DRBs and DFBs may also offer Islamic banking services through Islamic windows as per existing practice.

Setting up digital banks will also require less capital relative to the brick-and-mortar banks currently in existence, encouraging new technology-oriented entrepreneurs to enter this new realm of business.

The SBP expects that a few digital banks will be operational this calendar year, and is confident that these will play an important role in an inclusive and efficient expansion of the financial ecosystem in Pakistan.

SBP said it expects that a few digital banks will be operational in the course of 2022, and will play an important role in an inclusive and efficient expansion of the financial ecosystem in Pakistan.