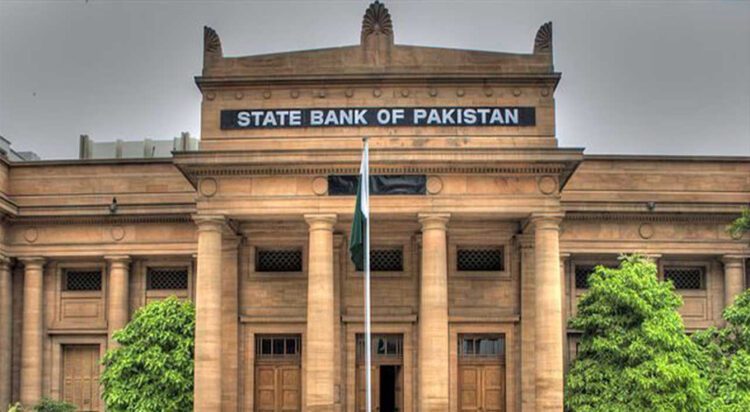

The State Bank of Pakistan (SBP) has purchased $5.9 billion from the domestic currency market between June 2024 and February 2025 in an effort to strengthen its foreign exchange reserves, despite continued support from the International Monetary Fund (IMF) and friendly nations.

According to a report by Topline Securities, the central bank acquired $223 million in February alone, contributing to the cumulative $5.9 billion in market purchases during the nine-month period. These interventions were made possible by higher-than-expected remittance inflows, which created space for the SBP to accumulate foreign currency. However, the bank still fell short of meeting its self-imposed reserves target.

In response to the surge in remittances from overseas Pakistanis, the SBP revised its foreign exchange reserves target for FY25 to $14 billion, while setting a new remittance projection of $38 billion.

Following the disbursement of $1 billion from the IMF on May 16 under the Extended Fund Facility (EFF), the SBP’s foreign reserves climbed to $11.5 billion.

Analysts note that nearly half of this total has been built up through aggressive dollar buying from the local market — a level that may mark a record for the central bank in terms of annual purchases.

Also read: Pakistan will need $115 billion in external financing during next 5 years: IMF

In addition to IMF support, Pakistan anticipates receiving $1.4 billion in climate financing under the Resilience and Sustainability Facility (RSF), which has already been approved by the IMF.