Pakistan’s Finance Minister, Muhammad Aurangzeb, unveiled the economic survey for the fiscal year 2024 during a press conference in Islamabad on Tuesday. The survey revealed Pakistan’s shortfall in meeting its economic objectives. This release precedes the presentation of the federal budget for the fiscal year 2024-25, scheduled for June 12 (Wednesday).

The Pakistan Economic Survey, an annual report, encapsulates the country’s economic trajectory for the outgoing financial year, spanning from July 1, 2023, to June 30, 2024. It serves as a crucial stage in the federal budget process, offering the public insights into Pakistan’s economic landscape.

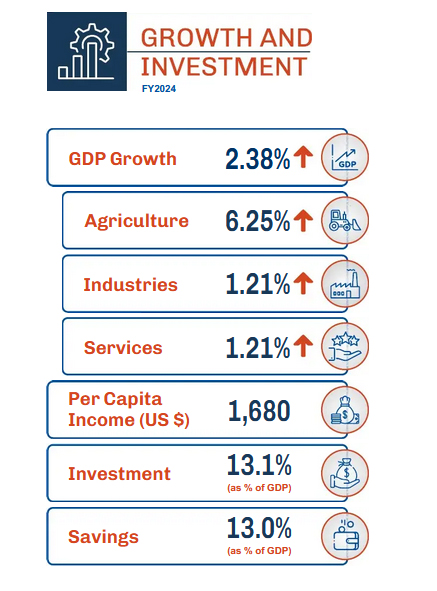

This pre-budget report furnishes an overview of Pakistan’s economy, spotlighting its performance across various sectors. Typically, it assesses key indicators such as GDP growth, inflation, trade, and investment, while also delving into sector-specific achievements in agriculture, industry, and services.

Key highlights from the economic survey include:

- In the fiscal year 2022-23, GDP contracted by 0.2%, alongside a 29% depreciation of the PKR and a decline in foreign exchange reserves, down to two weeks of import cover.

- Real GDP for 2023-24 (July-March) experienced a growth of 2.4%, a positive shift from the previous year’s contraction of 0.2%. However, this growth fell short of the targeted 3.5%.

- The agricultural sector demonstrated substantial growth, expanding by 6.25%, surpassing the targeted 3.5% and the previous year’s 1.55%.

- The Large Scale Manufacturing (LSM) sector faced challenges stemming from high interest rates and energy costs.

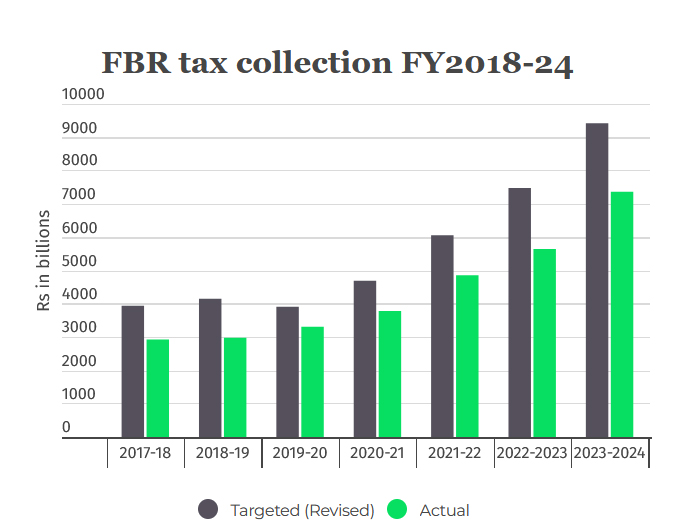

- Federal Board of Revenue (FBR) tax collection surged by 30.6% to Rs7,361.9 billion from July to April, compared to Rs5,637.9 billion in the corresponding period of the previous year. Despite this increase, it fell short of the government’s set target of Rs9,415 billion for the 12-month period.

- Foreign exchange reserves witnessed an improvement, surpassing $9 billion.

- Inflation rates plummeted from 38% to 11%, prompting the central bank to reduce the policy rate.