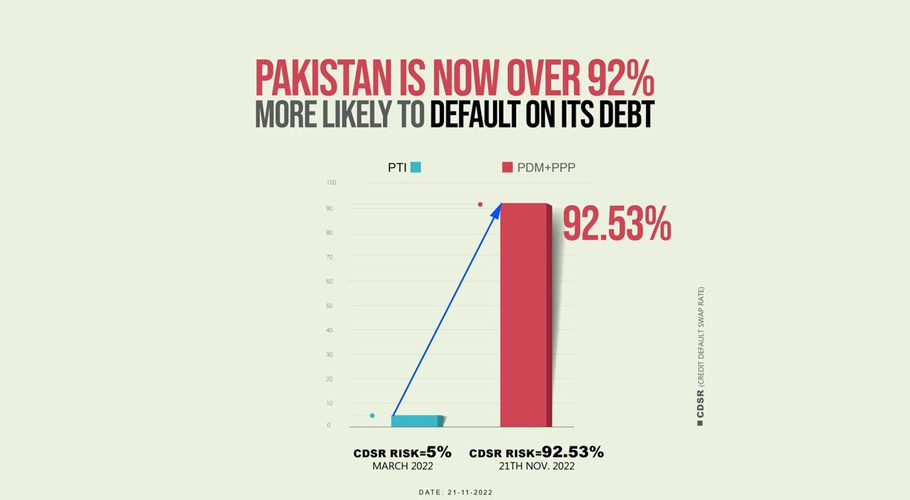

KARACHI: Pakistan’s five-year sovereign debt rose by 1,224 basis points over the weekend, hitting the highest ever level of 92.53 percent due to, what has been termed as, political and economic uncertainty in the country.

According to open source data available at different platforms, country’s credit default swap (CDS) had been at 4.2% in January 2021, but the perception of Pakistan’s risk of default has worsened with the five-year CDS surging by 30 percentage points in a week to 92.53% on Monday ahead of the repayment of $1 billion for a maturing international bond early next month.

Although Finance Minister Ishaq Dar and many financial experts have reiterated on multiple occasions that Pakistan would not default on any of the international payments and that volatility in the CDS had nothing to do with the country’s default risk, yields (rate of return) on the $1 billion international bond (Sukuk), which is maturing on December 5, 2022, soared to 120% on Monday from around 96% on Friday, indicating the investors’ lack of confidence in Pakistan whether it would be able to repay the maturing debt.

Experts believe the country’s sovereign dollar bonds would remain vulnerable unless and until the political standoff between the government and opposition is settled. It is pertinent to mention here that central bank’s foreign exchange reserves stand at $7.959 billion as of November 11 and are enough for less than six weeks’ worth of imports.