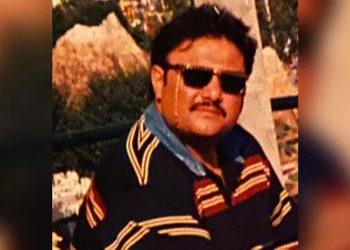

KARACHI: Former President Karachi Chamber of Commerce & Industry (KCCI) Zubair Motiwala has expressed deep concerns over the continuous devaluation of Pakistani rupees against US dollar, saying that the local currency’s fall has far-reaching implications.

In a statement, Motiwala urged the government that it was high time the State Bank must intervene to stop further freefall of Pakistani rupee and devise some kind of an effective mechanism for appreciating the value of Pakistani rupee to such an extent that dollar reverses back to its previous level of Rs150.

“On the other hand, the Federal Board of Revenue (FBR), which has been taking advantage of higher dollar value, must also be directed to either bring down taxes and duties or keep them charging at the same rate”, he added while speaking at a meeting held during the visit of a delegation from All Pakistan Motorcycle Spare Parts Importers & Dealers Association (APMSPIDA) which was led by Rehan Hanif.

Chairman BMG pointed out that at the time when Federal Budget for current fiscal year 2021-22 was announced in June 2021, the US dollar stood at Rs155, and all the duties and taxes were estimated as per the then dollar rate.

He explained that out of the total differential amount of more than Rs15 as the dollar still hovers above Rs170 as compared to the previous rate of Rs155 in June 2021, at least 40 percent of the said differential amount i.e., Rs6 on each dollar was silently being collected by FBR in shape of taxes and duties “which was highly unfair”.

He was of the opinion that a target of Rs5800 billion was set for revenue collection for FY 2021-22 at a time when dollar rate stood at Rs155 hence, the extra money being collected nowadays due to sharp rise in dollar rate must not be considered as an achievement by FBR but as penalty on masses and the business community as it was the FBR which has been playing a major role in fostering the inflation and overburdening the economy.

Zubair Motiwala said that due to rising dollar rate, high cost of doing business, frequent gas outages, deteriorating infrastructure and other civic issues along with drastic decline in purchasing power, the local industries have been suffering terribly and facing severe liquidity crunch which has resulted in limited business activities and it was really unfortunate that the government was not coming up with any workable solution for dealing with all these issues.